The number of bottom-fishing stocks from the VN-Index trading session at 1,240 points has been credited to accounts, leading to significant profit-taking by investors. Despite this, the selling pressure was well absorbed, allowing the market to continue rising. The VN-Index recorded its third consecutive gain, advancing to 1,280 points.

The stock market experienced strong fluctuations during the trading session on July 3 due to the profit-taking pressure. Foreign investors also net sold more than VND537 billion on the HOSE after reducing net selling in the previous session. However, banking stocks continued to break through, spreading positivity across the market and contributing to the VN-Index's third consecutive gain.

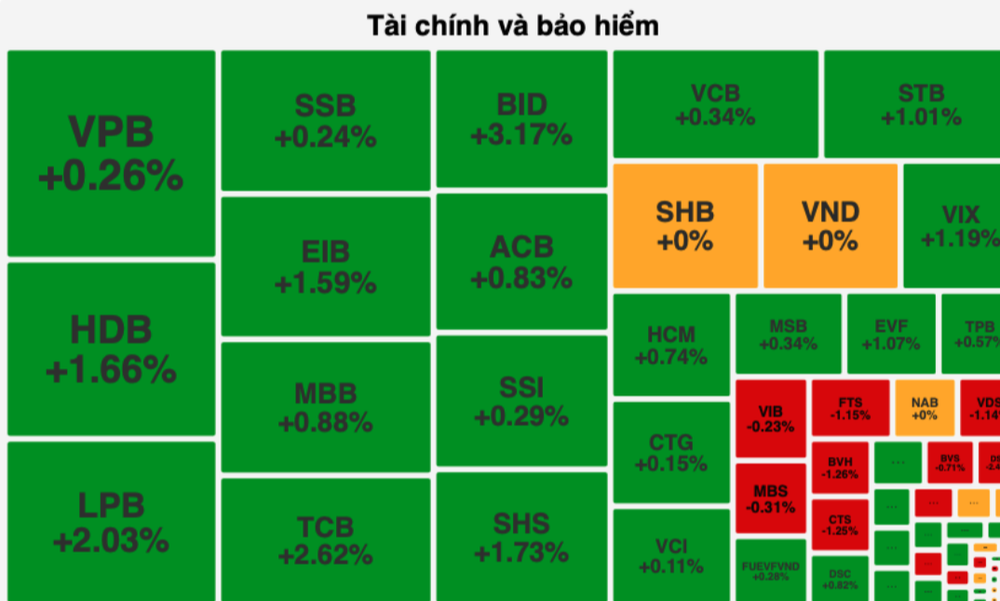

In detail, many banking stocks surged. BID soared by 3.17 percent, STB climbed by 1.01 percent, LPB rose by 2.03 percent, HDB gained 1.66 percent, EIB increased by 1.59 percent, and TCB advanced by 2.62 percent.

The securities sector also maintained its upward trend with modest gains. VIX edged up by 1.19 percent, SHS rose by 1.73 percent, and SSI, HCM, and VCI saw nearly a 1 percent increase.

Stocks in the manufacturing sector continued to perform well. DPM surged by 1.79 percent, VHC gained 1.26 percent, DCM rose by 1.21 percent, DPR jumped by 2.15 percent, AAA climbed by 1.77 percent, and BFC soared by 2.83 percent.

However, the real estate sector faced significant selling pressure and ended the trading session in red. VRE declined by 1.84 percent, HDG dropped by 1.2 percent, NTL fell by 1.64 percent, DXG decreased by 1.24 percent, and PDR slid by 1.02 percent. VIC, VHM, DPG, KDH, and NLG also experienced drops of nearly 1 percent.

In addition to banking stocks, FPT's 2.34 percent increase contributed to the VN-Index rising by almost 8 points.

By the end of the trading session, the VN-Index rose by 7.06 points, or 0.56 percent, to close at 1,276.85 points, supported by 242 advancing stocks, 161 declining stocks, and 80 standing still stocks. Similarly, the HNX-Index gained 0.63 points, or 0.26 percent, to reach 241.4 points, with 86 stocks increasing, 71 decreasing, and 64 unchanged. Market liquidity improved notably, with the total trading value on the HOSE reaching nearly VND15.6 trillion, up VND1.6 trillion from the previous session.