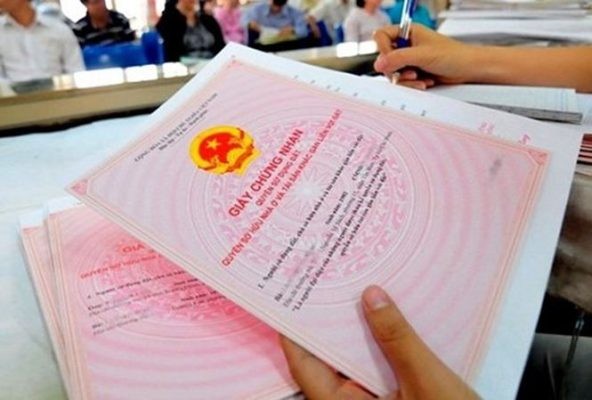

The Ho Chi Minh City Tax Department has urgently submitted a document to the People's Committee of HCMC regarding the resolution of land records since August 1, 2024. This is the second time the department has petitioned the People's Committee on this issue.

According to the department, between August 1 and August 27, the tax authority received a total of 8,808 files. These included 346 cases involving the collection of land-use fees for the recognition of land-use rights and 277 cases related to fees for land-use purpose conversion.

Furthermore, 5,448 cases involved personal income tax from real estate transfers, while 2,737 cases were exempt from financial obligations, including personal income tax on real estate transfers and registration fees.

The HCMC Tax Department has recommended that the People's Committee of HCMC promptly issue a decision to adjust the land price list and provide guidance on the application of relevant legal documents, such as the land price list, land price adjustment coefficient, and percentage rate for calculating land rental fees, for the tax authority to promptly calculate the financial obligations related to land for cases arising from August 1, 2024.

Additionally, to avoid backlogs, complaints, and disruptions to the legitimate needs and rights of residents, the department will report to the General Department of Taxation on how to handle cases where no financial obligations arise during the land certificate application process for residents.

Previously, on August 1, the department issued Official Dispatch No.7825, highlighting challenges in processing land-related files under Decision No.02 of the People's Committee of HCMC, which pertains to the application of the land price list as stipulated in Article 159, Clause 1 of the 2024 Land Law.

Regarding this matter, on August 18, the People's Committee of HCMC submitted a request for guidance from the Prime Minister on calculating financial obligations for land-related cases arising after August 1, 2024, until the adjusted land price list is implemented. The city is currently facing difficulties in handling administrative procedures related to financial obligations during the transitional period, from August 1, 2024, until the adjusted land price list is issued in accordance with Article 257, Clause 1 of the 2024 Land Law.

The People's Committee of HCMC has requested that the Prime Minister direct the Ministry of Natural Resources and Environment and the Ministry of Finance to issue guidance, providing a legal basis for the city to implement these procedures.