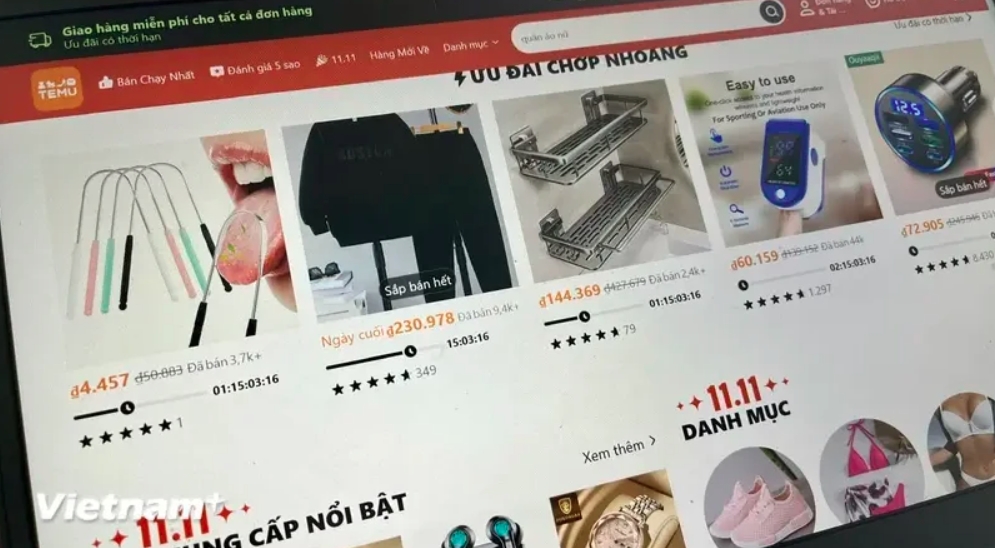

Media outlets have covered the issue of unfair competition posed by the e-commerce platform Temu in the Vietnamese market, as it operated without official licensing, engaged in large sales, and drove local businesses at a competitive disadvantage.

The GDT reported that on September 4, Temu’s parent company completed tax registration through its electronic portal for foreign suppliers and was issued the tax code of 9000001289.

Regarding tax declaration and payment deadlines, the department noted that, as per regulations, starting from the third quarter, Temu would begin filing declarations of its revenue generated from the start of its operation in Vietnam, with the deadline being October 31.

The GDT said tax management for both domestic and cross-border e-commerce platforms operating in the country is enforced rigorously, ensuring accurate, sufficient, fair, and transparent tax collection in accordance with the law.

In addition, the department affirmed it will continue to facilitate a conducive environment for entities engaging in production and business activities in Vietnam and fulfilling their tax obligations to the state budget.