|

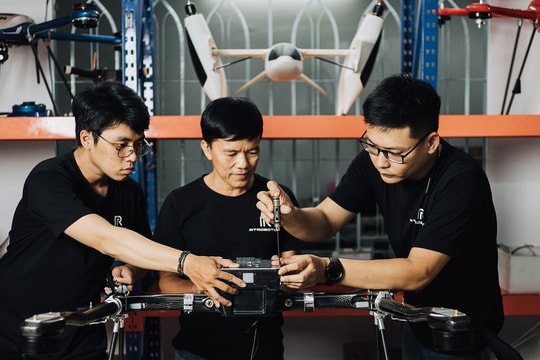

| Diệp Thị Trang (middle) and local women weave bamboo souvenirs. Photo baochinhphu.vn |

HÀ NỘI - Before 2005, farmers from ethnic minority groups in M'Drắk District, in the Central Highlands province of Đắk Lắk, had to sell young rice to traders at cheap prices to cover their household’s daily expenses.

Many of them became the victims of 'black credit' - a practice of borrowing from individuals at high interest rates agreed on between borrower and lender, without collateral and with only the borrower’s signature.

Thanks to the assistance of the provincial social policy bank, since 2005, local farmers have been able to access credit policy and loans to escape poverty.

Y Hoan Ksơr, head of M'Lốc B Village, Krông Jin Commune, said at that time each house could get access to VNĐ3 million. Rice was no longer sold early before the crops arrived and now farmers could wait until the harvest.

Being a Party member and deputy secretary of the village’s Party committee, Y Hoan Ksơr shared information about the credit policy and encouraged locals to raise cows and pigs and plant acacia in order not to waste land.

Ninety six out of 120 households in the village were classified as poor households.

Currently among 150 households, there are only 52 poor families. All households have TV sets and motorbikes while more than 30 families own houses worth over VNĐ500 million each.

Thanks to the credit policy mentioned in Directive No. 40-CT/TW of the 11th Party Central Committee’s Secretariat on enhancing the Party’s leadership over social policy credit, the poor and near-poor rate in Krông Jin Commune dropped from 42.67 per cent and 19 per cent in 2021 to 28 per cent and 11.6 per cent, respectively by the end of 2023.

Đại An Commune, Trà Cú District, in the Mekong Delta province of Trà Vinh is another locality active in implementing Directive No. 40-CT/TW.

The Chairman of the commune People’s Committee has participated in the representative board of the district’s Management Board of Social Policy Bank.

Nguyễn Trường Tam, Chairman of Đại An Commune People’s Committee, said: “My responsibility is to disseminate Party and State policies and laws to local people, especially credit policy, so that locals can access loans, develop crops and livestock, realising the commune's economic structural transformation orientations.”

Local authorities have encouraged ethnic people to share and help each other develop economy.

Trần Kẹo, head of the management board of Giồng Lớn Pagoda, said in the past, the most difficult thing for local Buddhists was capital. “We have coordinated with the local Party Committee, People's Committee and Vietnam Bank for Social Policies to disseminate guidelines, policies and loan programmes.

"The people and Buddhists of Giồng Lớn Pagoda are happy to receive loans from the Social Policy Bank to get access to jobs, from which the family's life will be stable,” he said.

Diệp Thị Trang, a local of Đại An Commune, is a pioneer in converting bamboo agricultural tools into miniature models used as souvenirs for tourists and she has opened classes to teach others in the hamlet how to make handicrafts.

Knowing that the women find it difficult to buy raw materials, she encouraged the women to borrow loans to increase production.

To date, her handicraft facility has employed up to 87 women, of which 52 women have taken on loans.

Trang’s miniature rural living utensil product set has been recognised as a standard OCOP product of the province.

For her, the greater happiness is being able to create jobs for women, who now earn an average income of VNĐ5 million per month.

"I feel happy because the group members are able to borrow loans to make handicraft products. Now everyone has escaped from poverty," she said.

The models in Đắk Lắk and Trà Vinh provinces are only two examples to demonstrate the effectiveness of the Government’s credit policy.

After ten years of Directive 40-CT/TW, the total credit for the Vietnam Bank for Social Policies has surpassed VNĐ373 trillion, while outstanding debt has reached nearly VNĐ351 trillion, helping more than 3.1 million households escape poverty, and over 4.2 million people get jobs. The loans also provided support for more than 610,000 students, many impoverished people and other policy beneficiaries. VNS